Here’s what Citi should have done and what they should do get back

Financials and unit economics. A bank can only survive if its profitable and consumers have trust over it. Otherwise there’s a SVB like incident just looming anytime.

Citi’s redemption

webpage

trashy looking backwards webpage with zero investment or effort to make it better

current citi.com looks much better

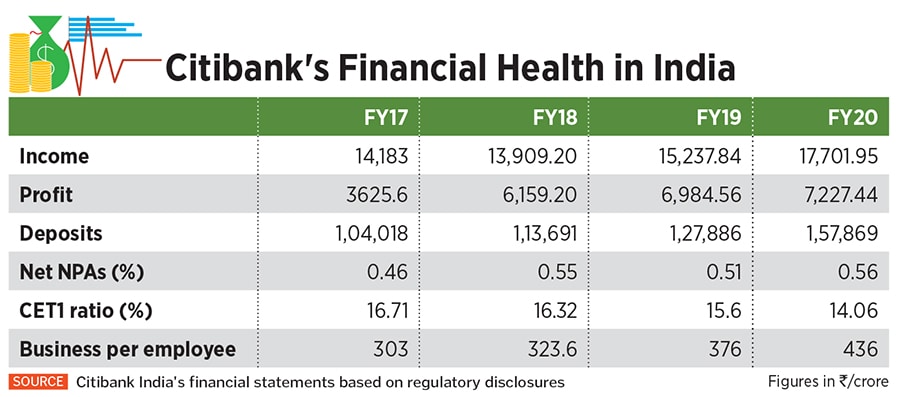

Stats

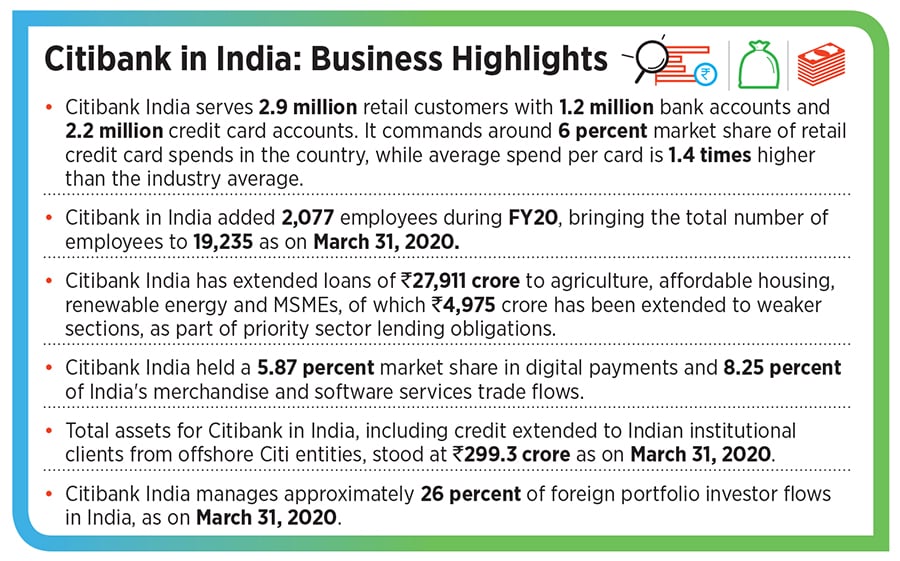

When citi’s consumer department was sold to Axis. Here’s what it looked like.

Citibank held an insignificant market share in India’s highly competitive retail banking sector, with only 0.6% of advances and 1.1% of deposits in 2020, significantly trailing local competitors like HDFC Bank and ICICI Bank.

1.6B $ USD sale to Axis on March 1 2023

Citi + Amex were the top premium banking providers in India (2021). A total share of 7.4% of the market with 4M active CCs. The two players have seen their cards in circulation dip by 4.7% and 3% respectively since April 2019.

Premium CC segment is 12-15% of the complete CC market. lucrative segment due to the high-spending nature of clients and relatively lower risk.

Citi had gone up to 11% market share of the Indian CC market but competitive landscape changed it all

Axis Bank is paying US$1.6 billion for the lot. But really, Citibank is the ultimate lending and wealth management portfolio in India. Look at what Axis is getting:

- 2.5 million credit cards, with spends averaging Rs 14,000 (~US 158)

- Rs 8,900 crore (~US$ 1.2 B) in credit card receivables

- Citi’s private banking and wealth management business in India, with Rs 1,10,000 crore (~US$14.5 billion) in assets under management. And mind you, this is not them distributing these products as an agent.

anecdotes

-

The stringent requirements around factors such as customer income and net worth helped Citi build a good base, its refusal to be more flexible with its requirements also made it harder for them to scale up. “That was the only reason they have failed in India,” - former SBI exec in Cards and payments division

-

Amex once ruled the commercial card segment, occupying 40-50% of the market, mostly concentrated around travel and entertainment spending. “India’s the only country where Amex’s commercial card volume superseded consumer volumes,” said the former Amex executive quoted earlier. The company has since lost ground to others such as HDFC Bank and HSBC in the segment, which leveraged their existing corporate banking relationships with large firms to move the volumes away from Amex, they said. The shift allowed banks to bundle services such as cards, treasury management, and corporate banking all in one place. For Amex, losing the commercial card business brought down its earnings per card. This, combined with Amex’s inability to issue new cards, cut into its business deeply.

why did they leave?

-

Qwen report:

-

Earned wage access.pdf :

-

RBI’s regulation for foreign banks 2013 https://rbi.org.in/upload/content/images/Annexure.html

products and initiatives

financials and economics

A bank like citi needs to balance its books It started as a premium bank catering to the top segment of people within the country. it started to lose the battle due to regulatory changes imposed by the RBI in 2013 Priority Sector Lending (PSL) Obligations WOS model

UPI they faltered in adoption digital payment infrastructure participation and technology investment in india they missed by 2022 citi was too far behind and had already lost the gold rush of indian fintech movement citi missed out on the Banking as a Service and NBFC market too Citi had cyber sec and other issues/attacks and costs to work with AI, open banking, and localized digital platforms hindered its ability to be relevant in a digitized market

According to Credit Suisse’s Global Wealth Report 2021, the Asia-Pacific region is projected to see a 71% increase in millionaires between 2020 and 2025, reaching 26.7 million individuals. Despite this lucrative growth potential, Citibank’s retreat from retail segments signals an untapped opportunity to leverage digital banking adoption trends among Indian consumers, who are increasingly prioritizing intuitive mobile apps and AI-powered services .

In conclusion, Citibank’s exit from Indian retail banking was influenced by systemic barriers, competitive pressures, and missed opportunities for innovation and collaboration. Adopting hybrid models, forming strategic partnerships, and aligning with emerging trends could have mitigated these challenges.

Lessons Learned for Future International Expansion:

- Citibank’s experience offers valuable lessons for other foreign banks in emerging markets:

- Agility and Alignment: The necessity of adapting swiftly to local consumer preferences and regulatory changes.

- Scalable Digital Solutions: Prioritizing investment in robust and localized digital platforms.

- Strategic Partnerships: Forming alliances with local tech providers and fintech companies to drive innovation and improve service delivery.

- Regulatory Compliance: Ensuring adherence to local norms and socio-economic priorities.

- Focus on Niche Markets (with Localization): Concentrating on high-value segments, but with a deep understanding of local nuances and the ability to deliver localized services.

financial docs

risk appetite and control

- Citi strives to serve as a trusted partner to its clients by responsibly providing financial services that enable growth and economic progress while earning and maintaining the public’s trust by constantly adhering to the highest ethical standards

- Citigroup Board of Directors, specifies the aggregate levels and types of risk the Board and management are willing to assume to achieve Citi’s strategic objectives and business plan, consistent with applicable capital, liquidity, and other regulatory requirements.

- citi-fy2015-risk.pdf

2015.

citibank corporate structure

as of 2015

*** Citigroup intends to exit its consumer businesses in Brazil, Argentina and Colombia. Effective in the first quarter of 2016, these businesses, which previously have been reported as part of Latin America GCB, will be reported as part of Citi Holdings

https://www.citigroup.com/global/investor/quarterly/2016/annual-report

stats

- revenue decreased by 1-2% since 2 years (2013-2015)

- profits increased after a bad year 2013: 13.7B 2015: 17.2B $

- AUM decreased by 8% since 2 years from 1,88T deposits also reduced

- Basel ratio improved by 1.5 pp for better risk coverage

- employee count down by 20k (10k each year)

- market cap volatile

- market cap < stockholder equity

- citi holdings AUM down by 40%

- sold 32B $ of assets

- Japan onemain financial: CC business

- share buyback and 6B $ distributed to shareholders

- reducing consumer banking income in Asia

- Asia consumer banking stats

goals for the previous year

- generate top line growth

- postive operating on core expenses

- reduce the expenditure on legal and repositioning (regulatory, and other changes)

key takeaways

- Visa partnered co branded exclusive issuer of 50M costco cards

- strategic partnerships with Apple pay, Android Pay (???), Samsung pay

- mastercard partnership for digital wallet: Citi Masterpass digital wallet

- Smart banking centers around the globe in major economic nodes

- Citi Fintech established to simplify mobile first banking (Borrow, Pay, Save, Invest and Protect)

- lots of other wealth management, corpo banking, heavy stuff

- IPOs

- pharma acquisition sale financing package

- GE debt exchange

- Treasury and trade solution growth: 3T $ monetary flow daily in 135 currencies

- solar plant - alamo texas- edison inc

- latam airlines

- mexico city airport infra financing

- and more more more

- small biz lending above 10B $ in that FY, total over 4years upto 40B

- 5B $ in affordable housing

- Citi is the world’s largest credit card issuer, with more than 138 million accounts, 133.2 billion in average receivables across Citi Branded Cards and Citi Retail Services.

- citi app on apple watch

- standardized credit product offerings

- Citi Simplicity®, a card designed for value-focused customers, in Poland and Russia,

- Citi Prestige®, geared to affluent customers, in the Philippines, Taiwan, Thailand and the United Arab Emirates. Citi Prestige now is available in a total of 13 markets

- Global rewards platform with Mastercard in 20 countries

- Citi Private Pass: Citi’s award-winning entertainment access program offered unmatched access and VIP experiences to Citi customers in the U.S

- Retail banking:

- Citigold, Citigold Private Client: personalized wealth management, set throughout Asia,

- Citi Priority: HENRY/HNW in HK

- Biometric mobile and ATM payment integration

- US small biz lending portfolio over 5 years ~ 46B $

- Mortgage and housing: 30B $ in 2015 FY (road to recovery)

- Private banking services

- exposure to fixed income markets by 60bp to 10.2 %

CSR and other non profit foundation stuff

- non profit monetary facilitation

- 100B ESG

- skill development

- greenhouse emissions reduction promises

- ghana electricity - 500 towns

message

- best year and recovery after 2008 financial crisis

- leaner company, reduced operational expense by cutting headcount by 30k, AUM by 130B $, branch network 30% ~ 182 operations centers, altered biz model

2016

citis goals and ambition

Citi understands what it missed out on. A foothold on emerging markets, expanding their existing premium HENRY/HNW/UHNW consumer base with their credit products. WOS and PSL obligations could be balanced by expanding into an increasing digital financial ecosystem and integration.